Case Study: Altova Customer Succeeds with XBRL

XBRL is mandated for most public companies. So why are private organizations and non-profits jumping on the bandwagon? This case study examines a real-world success story.  We were really excited when the folks at MACPA told us about their success working with XBRL. They set out to discover if XBRL could be used successfully (without a huge upfront investment) by small businesses and NPOs and ended up confirming not only that, but realizing benefits to their internal financial processes, as well.

We were really excited when the folks at MACPA told us about their success working with XBRL. They set out to discover if XBRL could be used successfully (without a huge upfront investment) by small businesses and NPOs and ended up confirming not only that, but realizing benefits to their internal financial processes, as well.

Toward Ubiquitous XBRL

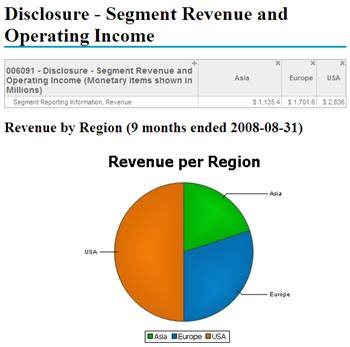

With close to 10,000 members, the Maryland Association of Certified Public Accountants (MACPA) is often looked to for their expertise on issues relevant to the field of accounting. The US Securities and Exchange Commission’s (SEC) mandate that public companies submit financial data in XBRL is one of those issues. Despite the potential of XBRL for reducing costs and increasing efficiency, many organizations are concerned about the time and expense that will be required to convert all of their financial data into XBRL, a process that can be further complicated when financial data is housed in multiple systems. MACPA set out to prove that these obstacles are easily surmountable: with the right tools, it’s possible to bring XBRL transformation in-house to not only comply with mandates, but realize greater efficiencies and transparency in various scenarios. In the process they discovered that tagging data in XBRL is valuable to private entities and non-profits as well as public companies facing a mandate. They took advantage of widely available XBRL software tools including the Altova MissionKit, which interfaces with multiple relational databases for XBRL mapping, tagging, and reporting.  In the end, the project turned MACPA’s financial data into a force for driving efficiencies and accountability. Once their internal accounting data was mapped to XBRL, they were able to automate burdensome data collection, transformation, and analysis tasks to gain more insight into their financial data. For instance, MACPA used their XBRL data to populate their financial Key Performance Indicator (KPI) system, significantly reducing the amount of time and effort required to prepare the KPI documentation. This in turn enables them to run the system at more frequent intervals. They are also now able to automate previously onerous tax filing tasks by mapping the association’s financial data in XBRL to the 990 tax return. (With almost 1.5 million exempt organizations in the US filing hundreds of thousands of Form 990s each year, the efficiency gained by using XBRL could be significant.)

In the end, the project turned MACPA’s financial data into a force for driving efficiencies and accountability. Once their internal accounting data was mapped to XBRL, they were able to automate burdensome data collection, transformation, and analysis tasks to gain more insight into their financial data. For instance, MACPA used their XBRL data to populate their financial Key Performance Indicator (KPI) system, significantly reducing the amount of time and effort required to prepare the KPI documentation. This in turn enables them to run the system at more frequent intervals. They are also now able to automate previously onerous tax filing tasks by mapping the association’s financial data in XBRL to the 990 tax return. (With almost 1.5 million exempt organizations in the US filing hundreds of thousands of Form 990s each year, the efficiency gained by using XBRL could be significant.)

“Ubiquitous XBRL could do for accounting/taxation what barcodes did for retail.” – Skip Falatko, MACPA Director of Finance and Administration

This project not only enabled MACPA to learn about XBRL and advise their members, but also to automate and enhance the way they dealt with their own financial data. And utilizing affordable tools like the Altova MissionKit confirmed that handling XBRL in-house is the way to go.

“Why outsource tagging [your data in XBRL]? If you tag it in house, then you own the data and can use it in myriad different ways as a productivity tool.” – Tom Hood, MACPA CEO and Executive Director

Check out the complete case study to learn how MACPA brought XBRL transformation in-house to effect changes in efficiency and transparency. If you’re an accounting or technical professional who needs to learn more about XBRL, Altova offers free, self-paced online training and an educational XBRL whitepaper.